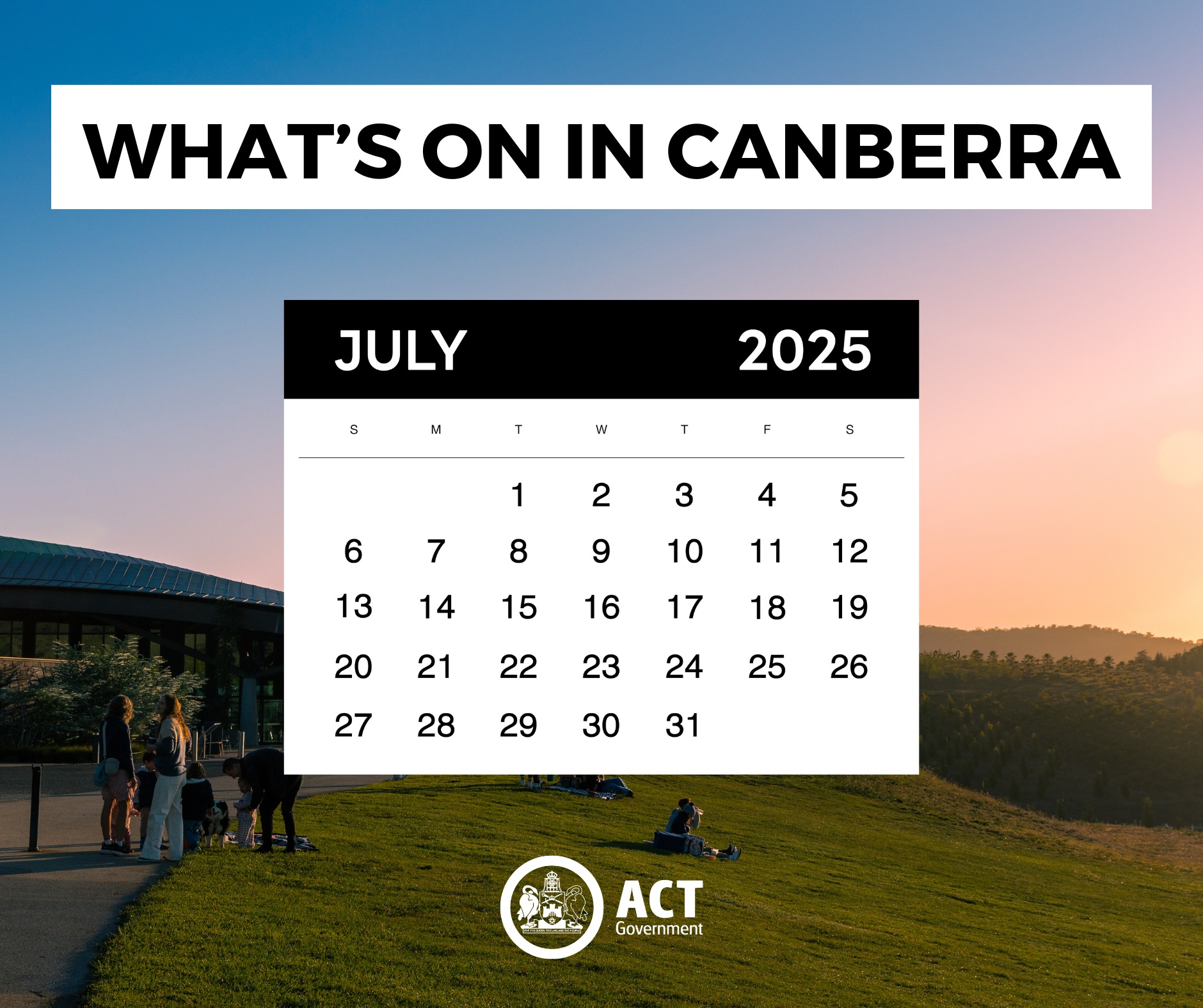

Canberra, 8 October 2025 – Not-for-profit (NFP) organisations with an Australian Business Number (ABN) are being urged to lodge their NFP self-review returns before the 31 October deadline. Failure to comply could result in significant penalties.

The self-review return helps confirm an organisation’s eligibility for income tax exemption. From 1 November, penalties for late lodgement can start at $1,650 and increase the longer the return remains outstanding.

The Australian Taxation Office (ATO) has advised that organisations awaiting the processing of a Change of Registration Details form do not need to request an extension, as their records indicate they are actively meeting obligations.

Repeated failures to lodge could trigger a review of an organisation’s income tax-exempt status, potentially requiring taxable NFPs to lodge overdue income tax returns or non-lodgement advice.

NFP leaders are urged to act now to avoid penalties and ensure their tax-exempt status remains secure.

For more information, visit the ATO’s website: Late Lodgement – NFP Self-Review Return.

For more information, visit the ATO’s website: https://www.ato.gov.au

Comments